In November 2024, Annata hosted the Annata Customer Industry Advisory Council—where key industry experts from the automotive, trucks & buses, and equipment sectors came together to discuss the significant changes shaping these industries. At this gathering, we conducted a survey that unveiled insights into the latest trends and challenges these industries face.

The data collected reflects a transformative period for these sectors, with responses that provide actionable insights into how businesses are adapting to changes in technology, customer expectations, sustainability, and the rise of digital transformation.

A cross-section of industry leaders from the Annata Customer Industry Advisory Council survey

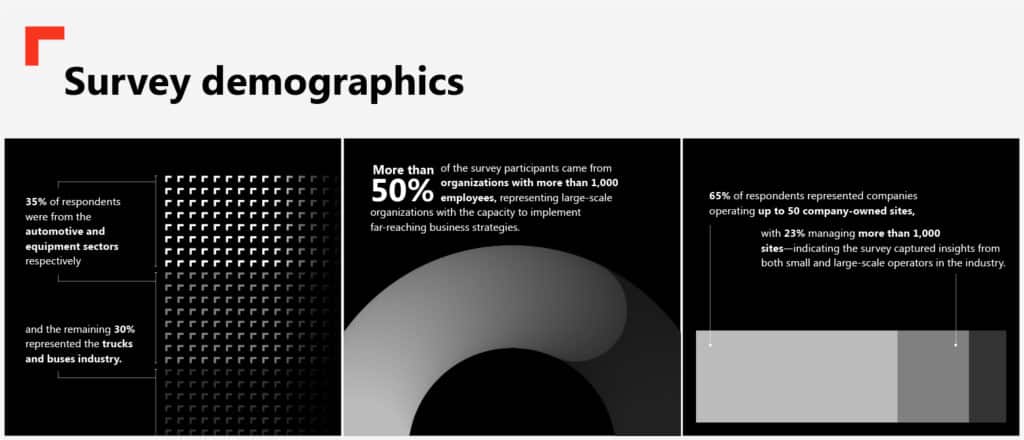

The survey involved responses from a diverse range of professionals across various departments, regions, and levels of seniority, offering a wide spectrum of perspectives.

Survey demographics:

The depth of experience in the Insights from the Annata Customer Industry Advisory Council survey sample was equally notable:

- 58% of respondents held senior roles, such as Directors, Managers, or Heads of Departments, ensuring that the findings represent high-level, decision-making professionals.

- 23% were Subject Matter Experts in IT or Solutions, giving the survey a robust technological perspective.

- 11% were C-level executives, sharing their strategic viewpoints on the industries.

- 8% held specialized roles in specific departments, such as sales, service, and operations.

These participants represented various departments:

- 39% from IT Business Applications.

- 23% from Sales.

- 38% from operational areas like Aftersales, Dealer Networks, Parts, and Supply Chain.

The variety of expertise ensured the findings from the Annata Customer Industry Advisory Council survey captured a broad understanding of the trends influencing industry development.

Industry experience: Deep expertise across sectors

This level of industry experience was crucial for providing insights into both historical trends and future shifts, contributing to a rich understanding of where these sectors are heading.

Key trends driving transformation across industries

-

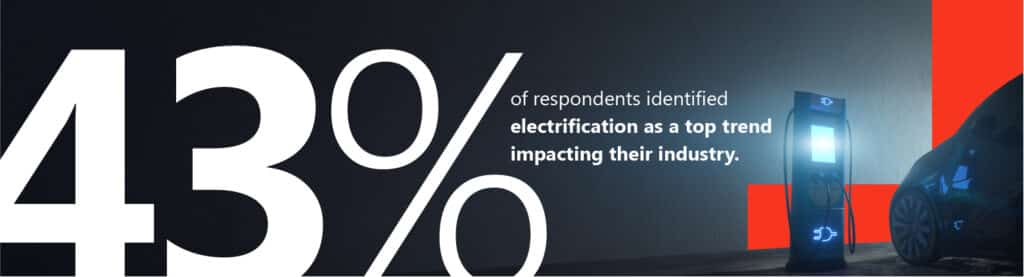

Electrification: The shift towards Electric Vehicles (EVs)

Electrification is among the most disruptive forces in the automotive and trucks & buses sectors. As environmental regulations tighten and consumer demand for cleaner alternatives grows, the push towards electric vehicles (EVs) is accelerating.

This trend is not limited to passenger cars but extends to commercial vehicles, including trucks and buses, and even construction equipment.

- The International Energy Agency’s (IEA) Global EV Outlook 2024 reports EV sales increased by approximately 25% in Q1 2024 compared to the same period in 2023. The growth is attributed to factors such as competition among OEMs, decreasing prices of batteries/vehicles, and ongoing policy support.

- The shift to EVs is having a profound impact on the aftersales service market. As electric vehicles require different maintenance and repair strategies, businesses in the automotive and equipment sectors need to rethink their service offerings.

The electrification of vehicles opens up opportunities for new business models, including battery leasing, charging infrastructure development, and maintenance services tailored to electric vehicles.

-

Digital transformation and the Internet of Things (IoT)

The IoT is fundamentally changing how companies manage their assets, fleet operations, and customer service.

Sensors, connected devices, and real-time data are providing businesses with unprecedented insights into the performance and health of their vehicles, equipment, and operations anytime, anywhere.

- IoT-enabled devices allow companies to gather data from vehicles and equipment, enabling more efficient fleet management, predictive maintenance, and operational optimization.

- With connected devices, businesses can monitor the health of their vehicles or equipment in real-time, reducing costly repairs and minimizing downtime. Real-time data is also helping businesses improve customer experiences by enabling more proactive and personalized services.

- McKinsey reported that 55% of automotive executives identify connected vehicle capabilities, driven by digital transformation and IoT advancements, as a critical trend shaping the industry’s future

By embracing digital transformation, companies can enhance operational efficiency, improve fleet performance, and provide new, innovative services to customers.

-

Sustainability and Corporate Social Responsibility (CSR)

Sustainability is a growing priority for the automotive, trucks & buses, and equipment industries, driven by stricter emissions regulations, consumer demand for eco-friendly products, and the push for corporate social responsibility (CSR).

Companies are increasingly focused on reducing their environmental footprint and adopting cleaner technologies.

- McKinsey estimates that operational efficiency improvements, driven by advanced analytics and digitization, are projected to boost profit pools in the truck sector by €2.9 billion.

- As a result, companies are increasingly focusing on the environmental impact of their operations, from sustainable production methods to offering green vehicles.

- The European Union’s regulations on CO2 emissions are pushing automakers to innovate faster and invest in cleaner technologies. This trend is reflected in the increasing adoption of electric vehicles and the development of hybrid vehicles by OEMs.

By adopting more sustainable practices, companies can not only comply with regulations but also differentiate themselves in the market by appealing to environmentally conscious customers.

-

Autonomous vehicles and smart fleet management

The development of autonomous vehicles and the rise of smart fleet management are pushing the boundaries of what’s possible in the automotive and commercial vehicle sectors.

These innovations are transforming how vehicles operate while offering exciting possibilities for future mobility solutions and the management of complex vehicle fleets in real-time.

- Autonomous trucks, buses, and construction equipment are beginning to emerge, and with this technology comes the potential to revolutionize operations by reducing labor costs and improving safety.

- According to Mckinsey, autonomous vehicles are poised to deliver significant societal benefits and disrupt the industry, underscoring the integral link between autonomy and connectivity.

- Smart fleet management solutions that use AI and IoT are improving the efficiency of operations. For instance, predictive maintenance allows companies to anticipate when a vehicle or machine will need service, preventing unexpected breakdowns and minimizing downtime.

As autonomous technology continues to evolve, businesses that adopt these technologies early will have a competitive advantage in improving efficiency and reducing costs.

-

Artificial Intelligence (AI) and Machine Learning: The future of smart operations

- AI is already being used for predictive maintenance, where algorithms analyze real-time data to predict equipment failures before they happen, reducing downtime and repair costs.

- Gartner forecasts that enterprise adoption of generative AI will surge from under 5% in 2023 to over 80% by 2026, reflecting broad market acceptance and minimal resistance.

- Machine learning models are also helping companies optimize their supply chains and sales operations by identifying patterns in customer data and automating decision-making processes.

AI is playing a pivotal role in helping companies enhance efficiency, reduce operational costs, and deliver better customer experiences.

-

Augmented Reality (AR) and Virtual Reality (VR): Enhancing customer experience and training

- AR is being used to help technicians in the field by overlaying essential service information over a physical vehicle or equipment, allowing them to troubleshoot and repair more efficiently.

- VR is being used for immersive training environments, enabling technicians to practice repairs or operate equipment virtually, reducing the risk of accidents and enhancing learning outcomes.

- According to the Wall Street Journal, businesses are adopting VR for employee training, utilizing its immersive features to educate staff on subjects ranging from equipment maintenance to leadership skills and empathy development.

By embracing these technologies, businesses can not only improve operational efficiency but also provide more engaging customer experiences, particularly in service and sales.

-

Omnichannel customer engagement

- An omnichannel strategy allows businesses to offer a seamless experience across all customer touchpoints, from online platforms to physical dealerships. By integrating sales, service, and customer support, businesses can improve satisfaction, increase loyalty, and drive revenue growth.

- McKinsey reports a significant majority of B2B leaders (83%) believe that omnichannel methods are as effective or more effective than traditional approaches, indicating minimal resistance to adopting these strategies. By integrating digital touchpoints like online service portals with traditional methods, companies enhance operational efficiency and customer satisfaction.

-

Competitive shifts: Disruptors and tech giants entering the market

- McKinsey forecasts that by 2030, these new entrants could capture 20-25% of the market share, challenging traditional OEMs and driving innovation in areas like connected services, autonomous driving, and electric vehicles.

As a result, traditional industry players must accelerate their adoption of new technologies and business models to remain competitive and relevant.

A look toward 2030: Industry projections and the path forward

By 2030, the automotive industry alone is expected to generate $1.5 trillion in additional revenue driven by new business models, including EVs, autonomous vehicles, and connected services. However, 69% of leaders in the automotive industry expect significant disruptions from emerging competitors in the form of tech giants and mobility startups.

Despite these challenges, the future outlook for the industry remains optimistic, with 62% of respondents confident that their businesses will continue to thrive by adapting to these shifts.

Is your business digitally mature enough to keep up with industry trends? Find out by answering 25 questions in the Digital Maturity Assessment.

Conclusion: The road ahead

The automotive, trucks & buses, and equipment sectors are experiencing a rapid transformation driven by electrification, digitalization, sustainability, AI, and autonomous technologies. These trends are reshaping not only business operations but also customer engagement and service models.

Annata, through our A365 solution built on Microsoft Dynamics 365, provides businesses with the tools they need to navigate these changes effectively. By supporting the end-to-end process across the entire value chain, we enable organizations to stay ahead of the curve in a rapidly evolving market.

The future may be challenging, but with innovation, agility, and the right technology in place, businesses in the automotive, trucks & buses, and equipment sectors can position themselves to thrive in a new era of opportunity and growth.

For further information about the insights from the Annata Customer Industry Advisory Council, drop us a note today.

With insights from the CIAC campaign, one thing is clear—change isn’t coming, it’s already here. Is your business ready to keep up? Do you have the right tools to stay competitive?

Annata’s Digital Maturity Assessment helps you measure your digital readiness and see how you compare to industry leaders. Get personalized insights and a detailed report on where you stand and what steps to take next—all for free. Designed for businesses in the automotive, truck & bus, and equipment industries, this exclusive assessment helps you stay ahead in an industry that won’t wait. Take the assessment now.