Trucks and buses don’t just move freight and passengers; they move economies. When a truck fails to make its delivery window, the ripple spreads across entire supply chains. When a bus is pulled out of service, hundreds of commuters can be stranded, disrupting businesses, schools, and city life.

The importance of these vehicles has always been clear, but in 2026, the commercial vehicle industry is facing a reality where uptime, compliance, and customer trust matter as much as horsepower or payload capacity.

The future of this industry will not be defined only by engines, chassis, or drivetrains. It’ll be shaped by the digital systems that keep trucks and buses operating, profitable, and sustainable. The conversation is no longer just about vehicles on the road, but about the invisible intelligence working behind the scenes. While the shifts in the truck and bus industry for 2026 are not unheard of, they’ll be more apparent.

Everyday scenarios that define the stakes

These scenarios are not unusual. They represent the challenges that truck and bus operators encounter every day. They also highlight why the winners of 2026 will not necessarily be the businesses with the largest fleets, but the ones that can anticipate problems, stay compliant, and deliver better experiences to customers and passengers.

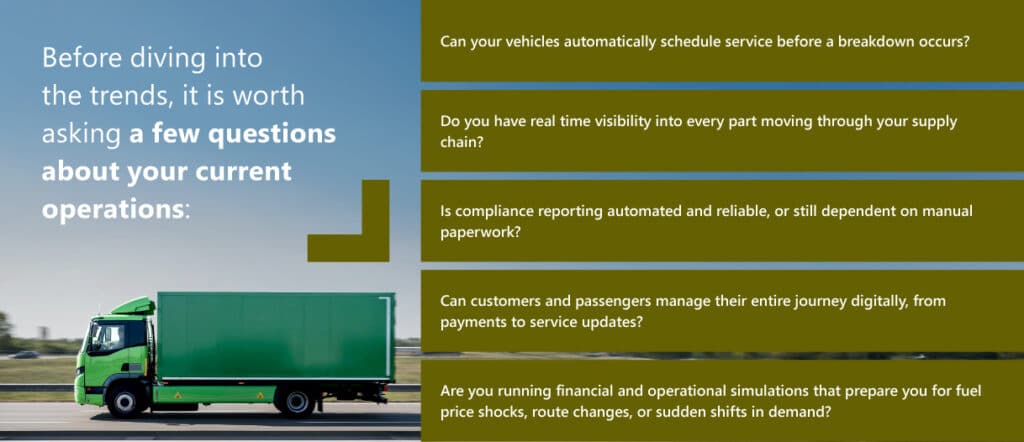

A readiness checklist for 2026

If you cannot confidently answer “yes” to all of these, your business is at risk of falling behind. The good news is that solutions are already here. The industry is being reshaped by a series of trends that are rapidly becoming best practices.

Let’s dive into what the shifts in the truck and bus industry for 2026 look like:

Shifts in the truck and bus industry for 2026 – Trend 1: Uptime becomes the new currency

In freight and transit, downtime is devastating. A truck that sits idle costs money by the hour. A bus that is not on its route reduces customer satisfaction and undermines trust. In 2026, uptime is more than a goal, it is the most valuable currency in the industry.

Artificial intelligence and connected diagnostics are making uptime predictable. Vehicles now generate alerts before drivers notice problems. Service orders are created automatically and parts are ordered ahead of time. Instead of waiting for a failure, operators are preventing it altogether.

For example, a refrigerated truck carrying perishable goods can detect a potential fault in its cooling system. The system automatically schedules a service stop and orders the replacement part to meet the vehicle at its destination. The cargo arrives on time, the client is satisfied, and the operator avoids both wasted goods and reputational damage.

Uptime has always mattered, but by 2026, it will become the single clearest indicator of whether a fleet is digitally mature.

Shifts in the truck and bus industry for 2026 – Trend 2: Compliance goes digital

The regulatory environment for trucks and buses is only becoming more complex. Cross-border freight requires customs and safety certifications. Municipal transit must adhere to emission reporting. Zero emission zones are being enforced in more cities. Managing these obligations with paper forms and spreadsheets is no longer realistic.

Digital compliance solutions are now critical. Blockchain-based records verify the origin of every component. ESG and emissions data are collected in real time and stored in audit-ready dashboards. Warranty claims and recall notices sync instantly with OEM systems, eliminating delays and errors.

Consider a bus operator competing for a municipal transit contract. The tender requires proof of emissions reductions across the fleet. With automated compliance tools, the operator can instantly generate detailed reports, backed by tamper-proof data. Instead of scrambling for records, compliance becomes a competitive advantage.

In 2026, operators who treat compliance as a digital process will not only avoid penalties, they’ll also win contracts by demonstrating transparency and accountability.

Shifts in the truck and bus industry for 2026 – Trend 3: Customer and passenger experience takes center stage

In the past, trucks were sold based on payload and reliability, and buses on seating capacity and safety records. These specifications remain important, but in 2026, customers and passengers make decisions based on the overall experience.

For logistics customers, this means the ability to track shipments in real time through a portal. For passengers, it means seamless mobile ticketing, accurate service updates, and personalized loyalty programs. For municipalities, it means clear sustainability dashboards tied to public reporting requirements.

A shipping company no longer wants just a truck to move goods. They want visibility into delivery progress, predictive alerts if something will be delayed, and simple digital billing. A city no longer wants just buses that move people. They want vehicles that integrate into their digital transit networks and support public sustainability goals.

The operators who deliver these experiences will build loyalty that outlasts contracts or vehicle specifications.

Profit margins in both trucking and public transit are notoriously thin. A single miscalculated investment or poorly planned route can erase profitability. Digital twins are changing this equation.

With digital twins, operators can simulate the performance of entire fleets under real-world conditions. An electric bus battery can be modeled against stop-and-go traffic patterns in a congested city. A trucking fleet can test the financial impact of rerouting 200 vehicles in response to a sudden fuel price increase.

These simulations allow operators to make decisions based on evidence, not guesswork. They reduce financial risk, optimize asset use, and allow for better long-term planning.

In 2026, running “what if” scenarios is no longer optional. It is an essential part of protecting profitability and ensuring resilience.

Shifts in the truck and bus industry for 2026 – Trend 5: Vehicles as a service go mainstream

The ownership model is evolving. Shippers and municipalities are increasingly moving away from buying vehicles outright. Instead, they want flexible access to trucks and buses through subscription or pay per use models.

In 2026, these models are powered by digital platforms. Contracts are linked directly to vehicle telematics. Billing is calculated automatically based on miles driven, hours of use, or payload carried. Operators and customers both gain real time visibility into usage, costs, and availability.

This flexibility appeals to customers who want to preserve capital and reduce maintenance responsibilities. It also provides operators with recurring revenue streams and scalable business models. What began as an experiment in mobility has now become a core part of the commercial vehicle industry.

Shifts in the truck and bus industry for 2026 – Trend 6: Integration becomes the hidden advantage

Perhaps the least visible but most powerful trend of all is integration. In the past, operators managed separate systems for telematics, compliance, parts ordering, and customer communication. In 2026, those silos are collapsing.

OEM data now flows directly into operator dashboards. Recalls and service bulletins sync instantly with fleet management systems. Dealer and OEM supply chains are connected, reducing delays and ensuring part availability. Telematics data is shared seamlessly between vehicles and operational platforms.

For example, when a manufacturer issues a recall, the affected vehicles in an operator’s fleet are automatically flagged, appointments are scheduled, and replacement parts are shipped in advance. The entire process happens without manual intervention.

Integration may not make headlines, but it reduces downtime, eliminates errors, and delivers the efficiency every fleet operator needs.

Why A365 is built for trucks and buses

At Annata, we understand these challenges because we have lived them alongside our customers. We have worked with OEMs, dealers, and operators through late-night supply chain crises, complex municipal compliance audits, and service disruptions that threatened client relationships.

That experience shaped the development of A365 for Trucks & buses. Unlike generic ERP systems, A365 is designed specifically for the commercial vehicle sector.

Because A365 is built on Microsoft Dynamics 365, operators also benefit from a proven enterprise backbone. Finance, operations, and CRM are integrated with Annata’s industry-specific enhancements, while Microsoft Azure, Copilot, and Power Platform deliver continuous innovation.

And this innovation is evergreen. A365 is not a platform you implement once and then watch age. It evolves continuously, with Microsoft’s global R&D investment ensuring that AI, compliance features, and integration capabilities are always up to date. For operators, this means no expensive overhauls or disruptive upgrades. Instead, your system grows with your business and with the industry itself.

The path forward

The truck and bus industry is not defined by technology for technology’s sake. It’s defined by the ability to keep goods moving, passengers satisfied, regulators confident, and operations profitable.

In 2026, the leaders will be those who embrace not just digital transformation, but digital mastery. With A365, Annata offers not only technology but also decades of expertise in commercial vehicles, equipping your business and team with what’s necessary to embrace and power through the shifts in the truck and bus industry for 2026. We know the realities of the industry, and we provide the tools to turn disruption into opportunity.

Want to get a personalized view of how A365 can help you ride the shifts in the truck and bus industry for 2026 with ease? Let’s connect.